Iran Riyal Collection Notes

The

Iran riyal was first introduced in 1798 as a coin worth 1250 dinar or one eighth

of a toman. In 1825, the rial ceased to be issued, with the qiran of 1000

dinars (one tenth of a toman) being issued as part of a decimal system. The rial

replaced the qiran at par in 1932, although it was divided into one hundred

(new) dinars.

Prior to decimalisation in 1932, these coins and currencies were used, and some

of these terms still have wide usage in Iranian languages and proverbs

In 1932, the exchange rate with the British pound was 1 pound = 59.75 rial. This

changed to 80.25 in 1936, 64.350 in 1939, 68.8 in 1940, 141 in 1941 and 129 in

1942. In 1945, Iran switched to the U.S. dollar as the peg for its currency,

with 1 dollar = 32.25 rial. The rate was changed to 1 dollar = 75.75 rial in

1957. Iran did not follow the dollar’s devaluation in 1973, leading to a new peg

of 1 dollar = 68.725 rial. The peg to the U.S. dollar was dropped in 1975.

In 1979, 1 rial equaled $0.0141. The value of Iran’s currency declined

precipitously after the Islamic revolution because of capital flight from the

country. Studies estimate that the flight of capital

from Iran shortly before and after the revolution is in the range of $30 to

$40 billion. Whereas on 15

March 1978, 71.46 rials equaled one U.S. dollar, in July 1999, 9430 rials

amounted to one dollar.

Injecting sudden foreign exchange revenues in the economic system forms the

phenomenon of “Dutch disease” in a country. There are two main consequences for

a country with Dutch disease: loss of price competitiveness in its production

goods, and hence the exports of those goods; and an increase in imports. Both

cases are clearly visible in Iran.

The solution is to direct the extra revenues from oil into the National

Development Fund for use in productive and efficient projects.

Although described as an (interbank) “market rate”, the value of the Iranian

rial is tightly controlled by the central bank. The state ownership of oil

export earnings and its large reserves, supervision of letters of credit,

together with current – and capital outflow account – outflows allows management

of demand. The central bank has allowed the rial to weaken in nominal terms

(4.6% on average in 2009) in order to support the competitiveness of non-oil

exports.

There is an active black market in foreign exchange, but the development of the

TSE rate and the ready availability of foreign exchange over 2000 narrowed the

differential to as little as IR100 in mid-2000.[17]

However the spread increased again in September 2010 because channels for

transferring foreign currency to and from Iran are blocked because of

international sanctions.

Monetary policy is facilitated by a network of 50 Iranian-run forex dealers in

Iran, the Middle-East and Europe. According to the WSJ and dealers, the Iranian

government is selling $250 million daily to keep the Iranian rial exchange rate

against the US dollar between 9,700 and 9,900 (2009). At times (before the

devaluation of the rial in 2013) the authorities have chosen to weaken the

national currency intentionally by withholding the supply of hard currency to

earn more rial-denominated income, usually at times when the government faces a

budget deficit.

The widening of the gap between official and unofficial exchange rates in 2011

stands at over 20% (as of November 2011). This shows the correlation between the

value of foreign currencies and the domestic inflationary environment.

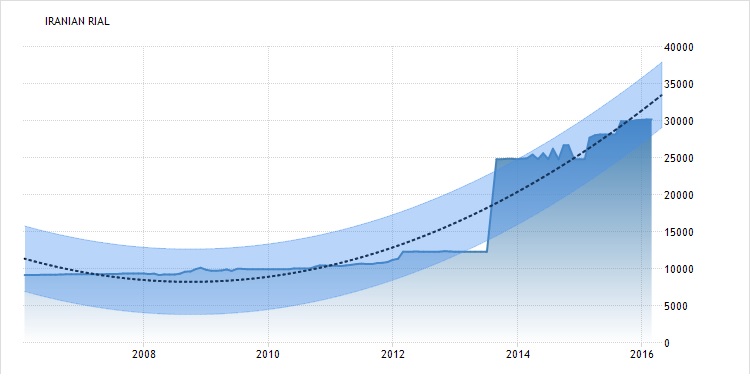

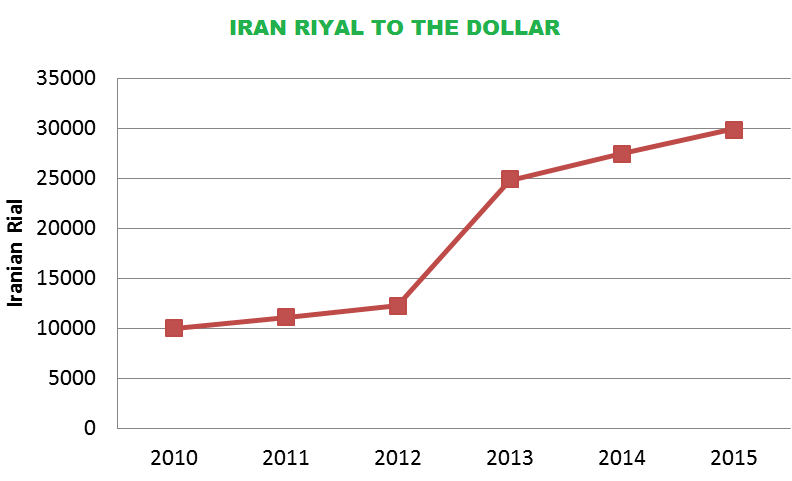

The unofficial rial vs. US dollar rate underwent severe fluctuations in January

2012 (losing 50% of its value in a few days, following new international

sanctions against the CBI), eventually settling at 17,000 rials at the end of

the period. Besides all the bad effects on the economy in general, this had the

effect of boosting the competitiveness of Iran’s domestic industries abroad.

Following President Ahmadinejad’s decision to liberalize the mechanism by which

bank interest rates are set (granting banks the authority to raise interest

rates to 21%),CBI

announced that it would be fixing the official rate of the rial against the

dollar at 12,260 rials from 28 January 2012 and seek to meet all demand for

foreign currency through banks.

On September 25, 2012, the Iranian rial fell to a new low, trading at 26,500 to

the US dollar. The drop followed the government’s launch of a foreign exchange

center a day before, that would provide importers of some basic goods with

foreign exchanges, at a rate about 2% cheaper than the open market rate on a

given day. The announced rate at the center on September 24, 2012 was 23,620

rials to USD. By early October 2012, Rial had further fell in value to about

38,500 Rials per USD in the free market. The Iranian rial was officially

devalued in July 2013